This post will explain best checkbook software for windows 10. A complimentary checkbook software is rather like the control panel of an automobile. While on a long drive individuals often glance at the readings for gas, speed and temperature, & miles. This is a straightforward thing to do. A checkbook software retains a track of the actions of individuals and gives them timely caution when issues occur.

Many such applications monitor and reveal one’s spending plan, banking, expenses, costs, investments, cost savings, financial obligations, and retirement plans. And, individuals can access all the info in one appropriate location. People who make it a practice of inspecting the numbers frequently are more likely to be much better off.

Top 6 Best Free CheckBook Software Alternative for Windows 10

In this article, you can know about best checkbook software for windows 10 here are the details below;

Numerous would rather keep an accountant for looking after their finances than do the budgeting themselves. They will find a totally free checkbook software extremely practical. There are many complimentary checkbook software. You are particular to get one that suits your financing requirements and assist you monitor your cash.

Listed below, we will evaluate 6 of the very best totally free checkbook software for users of Windows 10 which will conserve your money and time as well, continue reading!

1. GnuCash

Though it’s a complimentary application, GnuCash offers the power of a complete personal finance manager. Users can handle their everyday finances quickly. They can also track their purchases, stocks, retirement plans, and the sort quickly. The application is simple and versatile at the same time. Also check GlassWire Alternatives.

Functions

– With the assistance of the scheduling module companies can format routine deals and send digital prompts on due dates.

– Users can use the Income/Expense tool for categorizing flow of money and producing a revenue and loss declaration

– With the portfolio feature, users can keep track of stock markets and gather suitable details online

– The interface is plain and generally accounting professional. Those who do online banking can quickly find their location

Download: Click here

Submit Size: 178 Mb

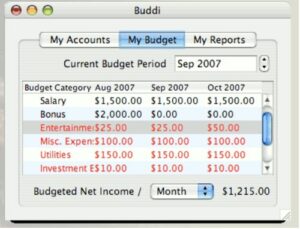

2. Buddi

Most people would rather pay an expert or utilize a costly computer system application instead of doing their budgeting. They will discover Buddi really valuable. This totally free application facilitates monitoring costs, preparing budget plans and evaluating financial routines.

Functions

– Users can tailor spending plans in line with their needs– there are default classifications that consist of income, home entertainment, vehicle, and more. There is likewise an option to develop customized spending plans. People with not so common earnings sources that consist of freelance payments can utilize this alternative

– Users can choose an account and a budget plan classification or classifications for each transaction that they do

– The reporting feature let users see all their costs in a month and compare them to their budget. Thus, they can see if they remained within or exceeded their spending plan.

You may also hold Microsoft Money which is different individual finance management software developed by Microsoft.

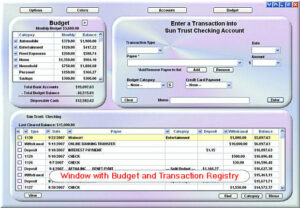

3. Checkbook Ease

Mint is a benefit for those who are preparing money management for the very first time. Setting it up is easy. The app links all accounts of users to one bank in a minute. Below are some of the functions of this application.

Features

– It’s exceptional in breaking down deals– Users can break down subcategories for easy sorting of their monthly costs. All deal are clearly labeled. Also check autoclickers .

– A pie chart system reveals users how their earnings and expenses break down. Users can adjust these charts for detecting spending for certain accounts, classifications, and time- durations. This function helps users adjust their costs practices.

– Users can generate budgets for numerous categories that include custom-made classifications. The application immediately fills them in. With some use, they can immediately track their spending.

– The Budgets and cost savings targets that appear as bar graphs help users make instant financial decisions

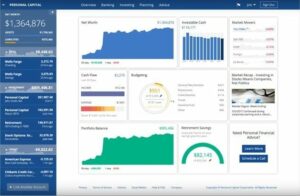

4. Personal Capital

Personal Capital serves as a financial aggregator for all accounts of users. This consist of cost savings, investments, loan accounts, inspecting, and credit cards. Users can assemble their entire financial life in one platform. The application likewise accepts retirement plans sponsored by employers.

Features

– Users can track their costs patterns by taking a look at their costs categories and private transactions. The monthly summaries include help users know where their money is going

– The application keeps track of the earnings and expenditures of users from all of their linked monetary accounts. Therefore, users can set financial targets and develop tactics for reaching them.

– While lots of people participate in employer-subsidized retirement plans few know their covert financial investment prices. This application determines the cost of all fund in a plan. Based upon this, uses get alternative arrangements into more cost-effective funds.

– This application assists users stay in line with their retirement goals. Hence, they can make the required changes for situations that include a career change.

– It assists users track their assets and liabilities for establishing their net worth and thus establishing their general financial standing

5. HomeBank

This is an accounting software for specific use that has lots of features. The functions make managing accounts, payees, spending plans, and costs a breeze. The straightforward and user-friendly interface fits both newbie and veteran users.

Functions

– Users can import the monetary information of their banks in OFX, QIF, CSV, QFX, and more formats.

– The application acknowledges replicate entries and asks users what to do with them. Users can set up repetitive transactions that include utility costs, lease, and more

– Users can handle numerous accounts that include bank, money, credit card, online payments, and more. They can fix initial and minimum balances for all accounts. Variation of money between accounts is possible and there is an alternative for setting a transaction as a template.

– There is a choice for tagging transactions for analysis at a later date

– The ‘Remind This’ function advises users of impressive payments and financial obligations

– Users have access to numerous potent tools for a better analysis of their costs

6. Buxfer

Buxfer comes out trumps in methodically presenting finances. Its comprehensive feature set and integrated mobile app give users everything they require for handling their household and company budget plan.

Features

– The application is best for budgeting. Users can choose categories and their spending limitations. Users can tag all transactions by classifications. The application mechanically records where the money goes and analyses the users’ over & under-spending areas. Users can “rollover” the steelyard of any unspent budget into the coming month. Users can see the cash left in all their classifications. They can set a text message alarm when they invest more than their budget. They can put in suggestions for important products that consist of rent.

– The application has 3 report types, specifically Income, Expenditures, and Net Worth. Users can compare their expense in previous and present months.

– Users can sync their bank with the program for immediately downloading all deals from their bank to the program. The application is harmonious with all bank and charge card worldwide. The sync does not need the storing of electronic banking password on the application and therefore is safe and secure.

Conclusion

If you are not delighted with the totally free checkbook software then it’s high time that you begin utilizing comparable software which are given above. Ideally, you will have the ability to make some savings. A minimum of, you will have the ability to see where your money is going.